UAE VAT 201 Report in ERPNext

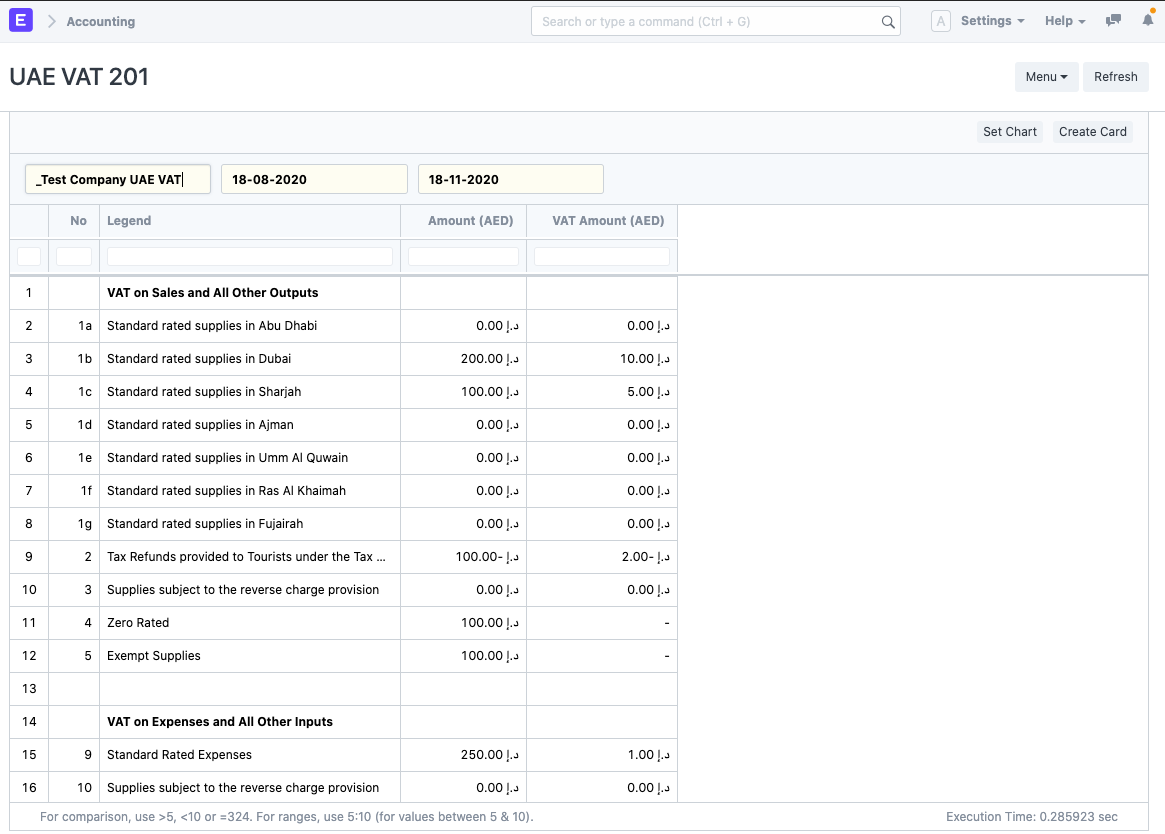

To generate UAE VAT 201 Report in ERPNext go to:

Accounting > Value-Added Tax (VAT UAE) > UAE VAT 201 or simply search for UAE VAT 201 in the awesomebar.

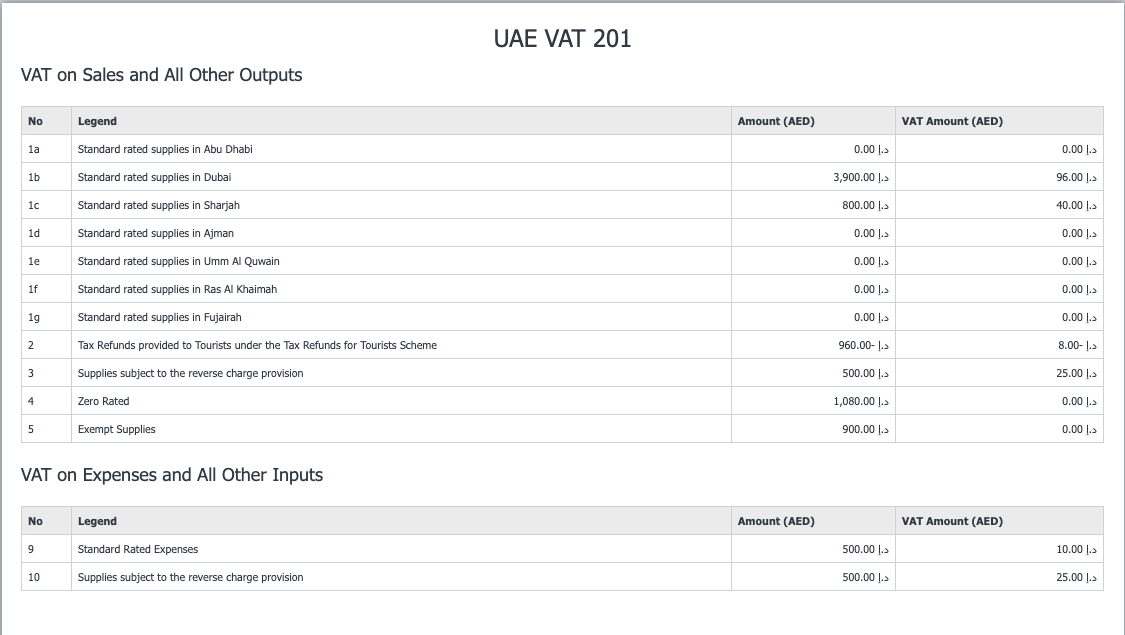

To print the report, go to Menu > Print as shown in the screenshot below.

Note: To make sure the calculations in the report are correct, check the following:

- Correct Emirate is selected in Company Address and Sales Invoice. The Sales Invoice Emirate field is auto filled using the selected Company Address but is editable.

- Zero Rated or Exempted Items have "Is Zero Rated" or "Is Exempt" checkbox checked in the item master.

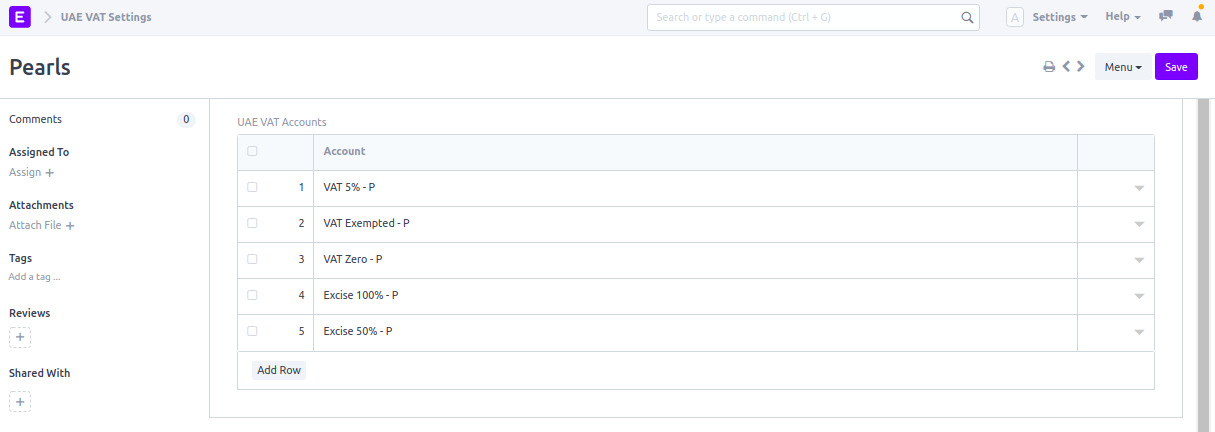

- All VAT accounts are selected in UAE VAT Settings.