Tax Inclusive Accounting

Use Case: Tax-inclusive pricing incorporates the sales tax paid by your customer into the item’s total price.

For example, If an item costs $100 with a tax rate of 10%, the customer still pays a flat $100, of which $9.10 is collected as tax. To configure this, following the following steps:

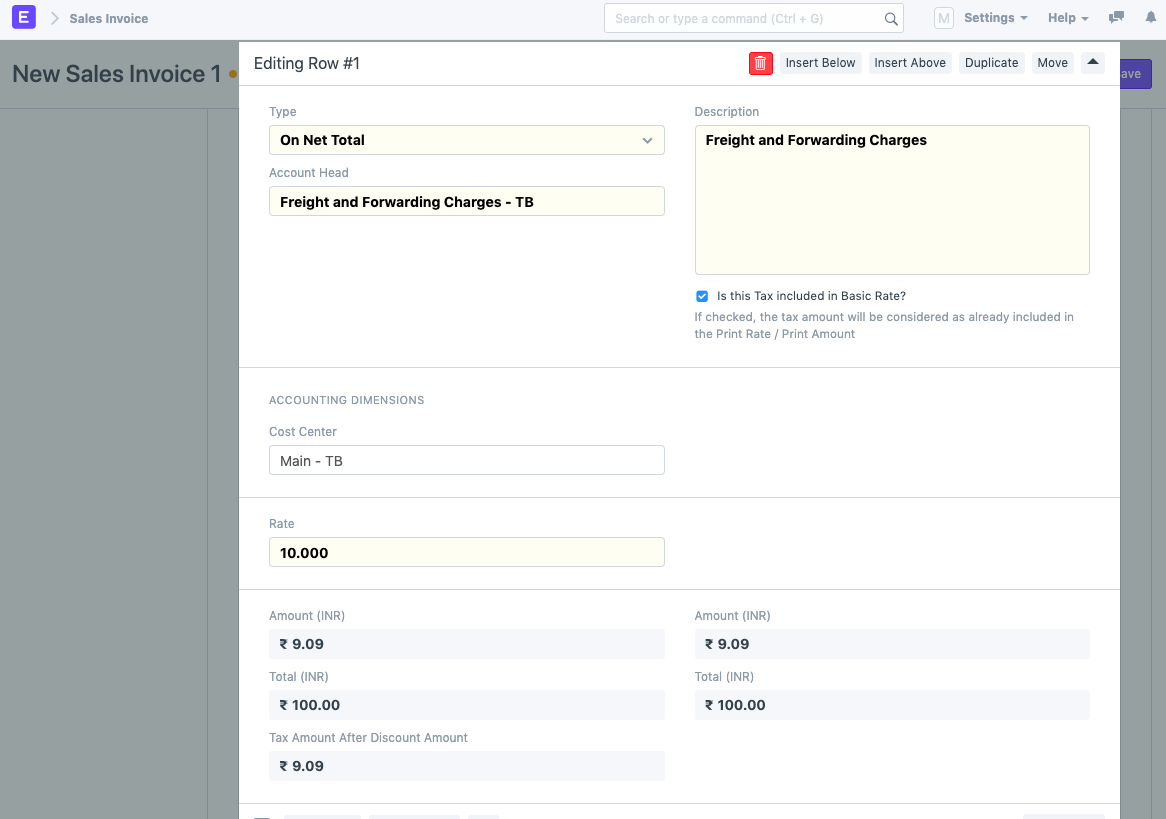

1) In the Sales Taxes and Charges section, go to the table view of the tax in question and expand the row.

2) Check the "Is this Tax included in Basic Rate?" checkbox.

The system back calculates the tax accordingly.